fulton county ga sales tax rate 2021

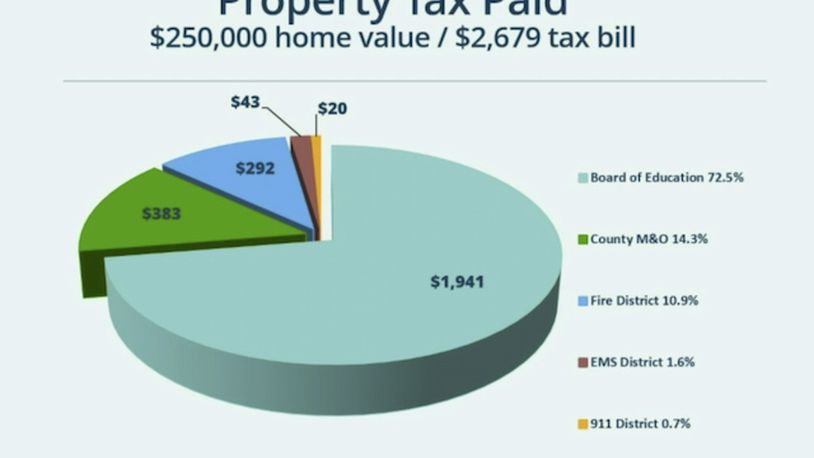

The median property tax in Fulton County Georgia is 2733 per year for a home worth the median value of 253100. Fulton County voters first approved the countys special purpose local option sales tax SPLOST for education in 1997.

Two Sales Tax Referendums Are On The Ballot In Fulton County Ajc Atlanta Voter Guide

GENERAL -Outside Village.

. A county-wide sales tax rate of 3 is applicable to localities in Fulton County in addition to the 4 Georgia sales tax. TOWN OF OPPENHEIM. Homeowners may qualify for different homestead exemptions from the various taxing jurisdictions including school system cities and Fulton County.

The tax rate for the portion of a motor vehicle sale that exceeds 500000 is 6 because the 1 2nd LOST and the 1 TSPLOST do not apply. View the 2021 Homestead Exemption Guide Once granted exemptions are automatically renewed each year as long as the homeowner continually occupies the property under the same ownership. Fulton County Tax Commissioner Dr.

Atlanta GA 30303. Even though the official due date for ad valorem tax payment is December 20th the local governing authority may adopt a resolution changing the official due date for tax payment to December 1st or November 15th or may implement installment billing with. And pursuant to the requirements of OCGA.

County Tax TownTax. Atlanta GA 30303 404-612-4000 customerservicefultoncountygagov. Genaral Outside Village.

The Fulton County Sales Tax is 3. The tax rate for the first 500000 of a motor vehicle sale is 7 because the 1 2nd LOST does not apply. 6 rows Sales Tax.

Yearly median tax in Fulton County. The Tax Commissioner takes the appraised value and the exemption status provided by the Board of Tax Assessors along with the millage rates set. Fulton County Sales Tax.

Voters renewed the tax for the fourth time in June 2017. 3 rows Fulton County GA Sales Tax Rate. The Fulton County Board of Commissioners does hereby announce that the 2021 General Fund millage rate will be set at a meeting to be held at the Fulton County Assembly Hall located at 141 Pryor Street Atlanta GA 30303 on August 18 2021 at 10 am.

The Fulton County Tax Commissioner is responsible for the collection of Property Taxes for Fulton County government Fulton County and City of Atlanta Schools the State of Georgia and the cities of Atlanta Mountain Park Sandy Springs Johns Creek and Chattahoochee Hills. From 1997 through 2021 the tax raised almost 25 billion in revenue for county schools. 48-5-32 does hereby publish the following.

Except when the first Tuesday of the month falls on a legal holiday in which case the sale is held the next business day. Interactive Tax Map Unlimited Use. Fulton County Sheriffs Tax Sales are held on the first Tuesday of each month between the hours of 10 am.

Property Taxes The Fulton County Tax Commissioner is responsible for collecting property taxes on behalf of Fulton County Government two school systems and some city governments. Fulton County Georgia Sales Tax Rate 2022 Up to 89. Fulton County has one of the highest median property taxes in the United States and is ranked 220th of the 3143 counties in.

Click for More Information. Average Sales Tax With Local. A TAX SALE IS THE SALE OF A TAX LIEN BY A GOVERNMENTAL ENTITY FOR UNPAID PROPERTY TAXES BY THE PROPERTYS OWNER.

Fulton County Sheriffs Tax Sales are held on the first Tuesday of each month between the hours of 10 am. GA Sales Tax Rate. General Rate Chart - Effective April 1 2020 through June 30 2020 2202 KB General Rate Chart - Effective January 1 2020 through March 31 2020 1878 KB General Rate Chart - Effective October 1 2019 through December 31 2019 1877 KB General Rate Chart - Effective July 1 2019 through September 30 2019 2167 KB.

County and county school ad valorem taxes are collected by the county tax commissioner. 6 rows The Fulton County Georgia sales tax is 775 consisting of 400 Georgia state. Sales Tax Breakdown.

VILLAGE OF BROADALBIN. Surplus Real Estate for Sale. Ferdinand is elected by the voters of Fulton County.

Fulton County in Georgia has a tax rate of 775 for 2022 this includes the Georgia Sales Tax Rate of 4 and Local Sales Tax Rates in Fulton County totaling 375. Fulton County collects on average 108 of a propertys assessed fair market value as property tax. Some cities and local governments in Fulton County collect additional local sales taxes which can be as high as 19.

Georgia has state sales. Georgia State Sales Tax. Atlanta GA 30303.

The Tax Commissioner takes the appraised value and the exemption status provided by the Board. TOWN OF CAROGA. Surplus Real Estate for Sale.

A tax sale is the sale of a Tax Lien by a governmental entity for unpaid property taxes by the propertys owner. Ad Lookup Sales Tax Rates For Free. Property Taxes The Fulton County Tax Commissioner is responsible for collecting property taxes on behalf of Fulton County Government two school systems and some city governments.

The current total local. County Tax TownTax. Except when the first Tuesday of the month falls on a legal holiday in which case the sale is held the next business day.

Appointments are not required for vaccines or booster shots at Fulton County vaccination sites. You can find more tax rates and allowances for Fulton County and Georgia in the 2022 Georgia Tax Tables.

Georgia Sales Tax Small Business Guide Truic

Georgia Property Tax Calculator Smartasset

Atlanta Georgia S Sales Tax Rate Is 8 9

Sales Tax On Grocery Items Taxjar

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Georgia Sales Tax Exemptions Agile Consulting Group

Georgia Used Car Sales Tax Fees

Sales Taxes In The United States Wikiwand

What Is The Fulton County Sales Tax The Base Rate In Georgia Is 4

Solid Waste Charges Billing Atlanta Ga

Property Taxes South Fulton Ga

Sales Taxes In The United States Wikiwand

Alabama Sales Tax Rates By City County 2022

Georgia Sales Tax Guide And Calculator 2022 Taxjar

Fayette County Approves Rolled Back Tax Rate

Georgia Sales Tax Rates And Compliance